The strength of the housing market has meant that many sellers have secured a record price for their home, but have been unable to find somewhere suitable for their onward purchase.

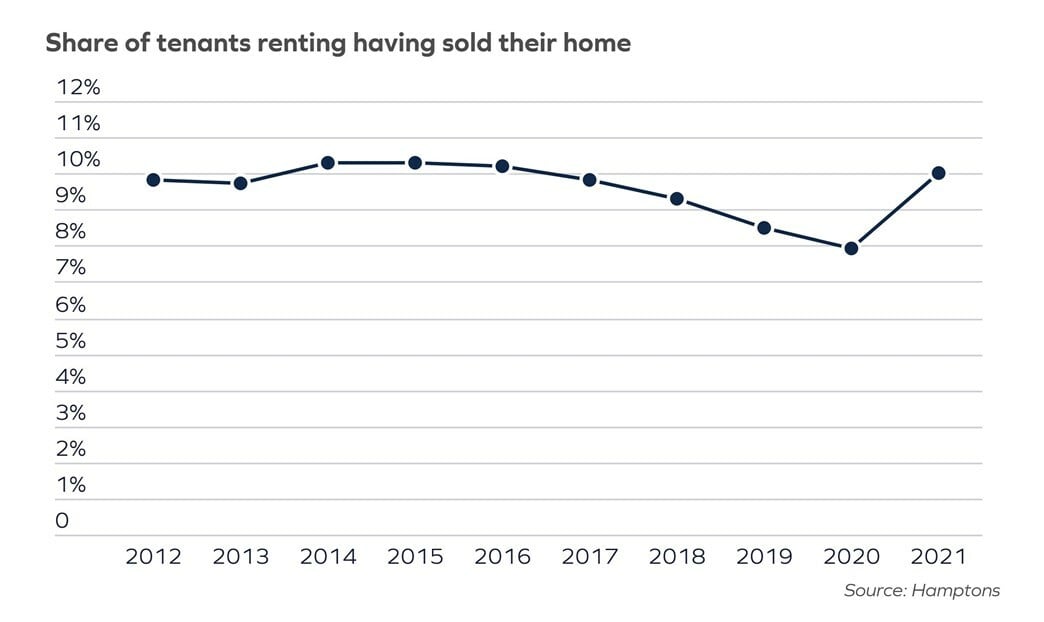

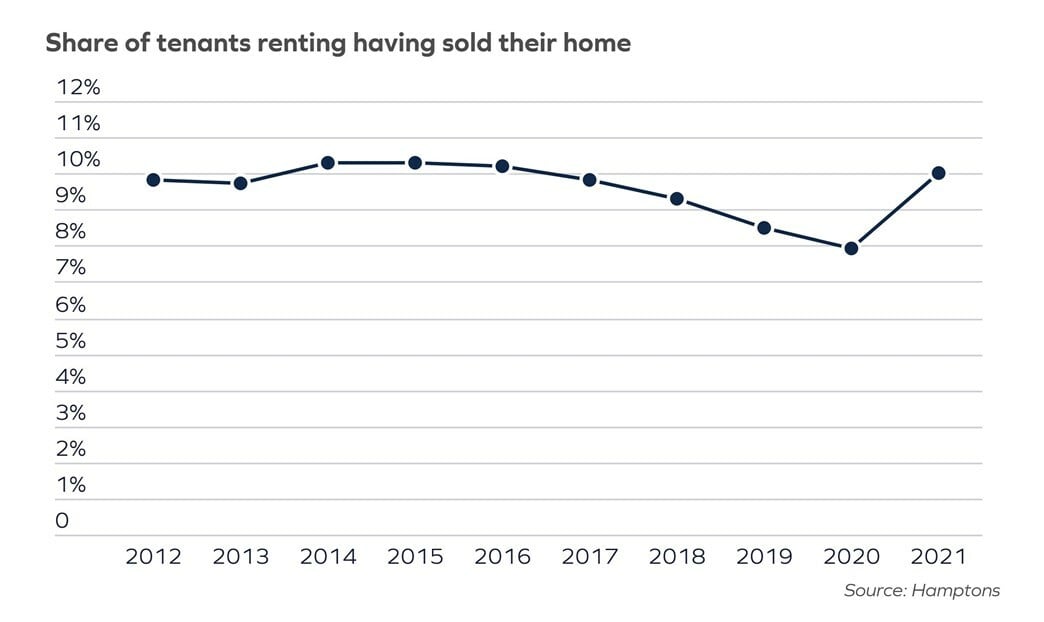

With 27% fewer homes available to buy in July than the same time last year, sellers who have struggled to find somewhere to buy have increasingly turned to the rental market to break their chain. So far this year 10.0% of new tenancies have been taken out by someone selling their home, the highest share since 2016. This is likely to equate to 117,200 ex-homeowner households becoming renters across Great Britain in 2021.

Sellers in Scotland, Wales and the North West, three of the country’s most competitive housing markets, have been most likely to rent following the sale of their home. Here, 16.4%, 15.3% and 11.8% of new tenancies respectively taken out so far this year were to someone who had sold their home. The numbers increased as the end of the stamp duty holiday approached, but have remained high subsequently.

Renting before buying has also been driven by house hunters making more long-distance moves. With growing numbers looking to live in areas they know less well, many more are trying before they buy. While moving into a rented home to get to know an area often isn’t people’s preferred option, it’s nearly always more cost-effective than buying the wrong house in the wrong street.

But the pandemic has acted as a catalyst for other rental moves. 49% of tenants – so far this year - moved because they simply wanted to live somewhere different. These are moves often driven by the search for more space. This was up from 48% in 2019 and 38% in 2012 when our records began. Meanwhile, 18% of tenants moved due to a change in family circumstances, a record high.

With workers less closely tied to the office, the proportion of tenants moving because of job relocations has fallen. So far this year just 11.5% of tenants moved for work, the lowest figure on record and down from 13.7% in 2019 (pre-pandemic).

The growing number of ex-homeowners looking to rent is contributing to the squeeze in rental stock as they compete with longer-term tenants. In July there were 43% fewer homes available to rent than at the same time last year, a fall that has accelerated significantly over the last four months.

And this lack of stock is underpinning rental growth, which remains well above normal levels, with few signs it’s likely to significantly slow over the coming months. Rents across Great Britain rose 6.2% in July compared to the same month in 2020. Southern regions, except for London, recorded the strongest annual rental growth.

Last month saw five of Great Britain’s 11 regions record their fastest ever rate of annual rental growth since the Hamptons Lettings Index began in 2014. Inner London rents continued their recovery, down 11.0% on the same time last year. This compares to an annual fall of 16.5% in June and 20.3% in May. Here the number of tenants registering was up 13% year-on-year, while the number of homes available to rent was down 45% on last year’s record highs.

Even though we’ve seen a rise in the number of homeowners who become temporary renters, the lack of homes available to rent is likely to suppress overall activity in the rental market this year. This means we could see fewer homes let in 2021 than in 2020, despite last year’s lockdowns.

The strength of the housing market has meant that many sellers have secured a record price for their home, but have been unable to find somewhere suitable for their onward purchase.

With 27% fewer homes available to buy in July than the same time last year, sellers who have struggled to find somewhere to buy have increasingly turned to the rental market to break their chain. So far this year 10.0% of new tenancies have been taken out by someone selling their home, the highest share since 2016. This is likely to equate to 117,200 ex-homeowner households becoming renters across Great Britain in 2021.

Sellers in Scotland, Wales and the North West, three of the country’s most competitive housing markets, have been most likely to rent following the sale of their home. Here, 16.4%, 15.3% and 11.8% of new tenancies respectively taken out so far this year were to someone who had sold their home. The numbers increased as the end of the stamp duty holiday approached, but have remained high subsequently.

Renting before buying has also been driven by house hunters making more long-distance moves. With growing numbers looking to live in areas they know less well, many more are trying before they buy. While moving into a rented home to get to know an area often isn’t people’s preferred option, it’s nearly always more cost-effective than buying the wrong house in the wrong street.

But the pandemic has acted as a catalyst for other rental moves. 49% of tenants – so far this year - moved because they simply wanted to live somewhere different. These are moves often driven by the search for more space. This was up from 48% in 2019 and 38% in 2012 when our records began. Meanwhile, 18% of tenants moved due to a change in family circumstances, a record high.

With workers less closely tied to the office, the proportion of tenants moving because of job relocations has fallen. So far this year just 11.5% of tenants moved for work, the lowest figure on record and down from 13.7% in 2019 (pre-pandemic).

The growing number of ex-homeowners looking to rent is contributing to the squeeze in rental stock as they compete with longer-term tenants. In July there were 43% fewer homes available to rent than at the same time last year, a fall that has accelerated significantly over the last four months.

And this lack of stock is underpinning rental growth, which remains well above normal levels, with few signs it’s likely to significantly slow over the coming months. Rents across Great Britain rose 6.2% in July compared to the same month in 2020. Southern regions, except for London, recorded the strongest annual rental growth.

Last month saw five of Great Britain’s 11 regions record their fastest ever rate of annual rental growth since the Hamptons Lettings Index began in 2014. Inner London rents continued their recovery, down 11.0% on the same time last year. This compares to an annual fall of 16.5% in June and 20.3% in May. Here the number of tenants registering was up 13% year-on-year, while the number of homes available to rent was down 45% on last year’s record highs.

Even though we’ve seen a rise in the number of homeowners who become temporary renters, the lack of homes available to rent is likely to suppress overall activity in the rental market this year. This means we could see fewer homes let in 2021 than in 2020, despite last year’s lockdowns.