Many of us have become accustomed to shortages over the past couple of years and house hunters are no exception. Such is the scarcity of properties for sale that since the onset of the pandemic, more people are selling their homes and moving into rented accommodation than they did before Covid-19.

While vendors are able to accept an offer on their home rapidly – often within days – they are coming under pressure from their buyers to find their onward purchase. This means sellers are increasingly turning to the rental market as a stop-gap to secure their sale and also to put themselves in a stronger position when they later go on to buy again.

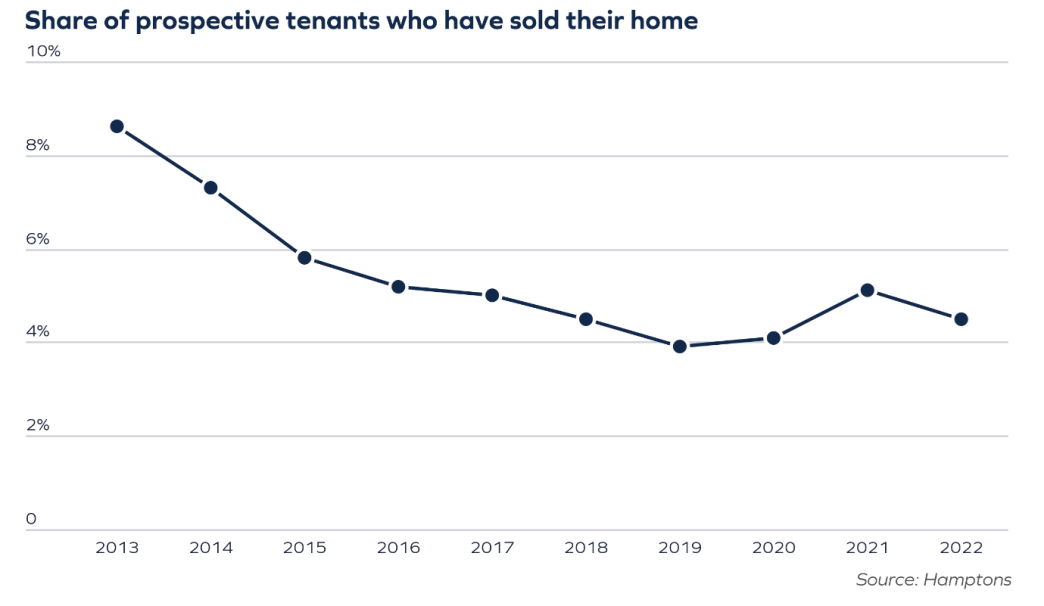

Across Great Britain, the share of prospective tenants who have sold their home is running at 4.5%, up from 4.1% in 2020 and 3.9% in 2019. In the countryside, the share of renters who have already sold has risen to 7.5%, up from 6.3% three years ago. On a regional basis, Wales has the highest share of stop-gap renters at 6.3%, a proportion that is 2.3% higher than in 2019.

Some of these accidental renters may be waiting some time until they can find somewhere else to buy. There were nearly a third fewer homes available to purchase across Great Britain in March than there were in March 2019; however, the number of buyers last month was 22% higher than it was three years earlier. Yet it tends to put them in a stronger position when they do come to buy given four in five sellers accepted an offer from a chain-free buyer over an offer from somebody who had a property to sell when they matched the price, up from just three in five in 2016.

The stock shortage extends across both cities and the suburbs, but is most extreme in the country, which has seen a surge in interest from buyers since the pandemic began. Sales stock in the British countryside last month was down 39% compared to March 2019, with buyer numbers up 21%.

Families and older homeowners are among those most likely to break their chain and rent. These would-be buyers have been hardest hit by the lack of homes for sale because the number of larger homes available to buy is down more than flats. These groups also typically move home less frequently – so when they do, they tend to look for a property that is futureproofed to a higher level than many others are seeking.

This new cohort of accidental renters is putting strain on the rental market, where the lack of homes is even more acute than it is for sales. There were 62% fewer rental homes available in March than there were in the same month in 2019, while tenant numbers were 4% higher.

Cities now see the biggest shortages of rental homes, with a 9% increase in tenant applicants in March 2022 compared to March 2019 and a 67% fall in available stock. However, with landlord purchases at a five-year high, we might gradually see a little more stock feed onto the market in the coming months, easing some of the pressure on tenants. While record levels of price growth will also convince many temporary tenants not to stay out of the market for too long.